Lean hog futures succumbed to a dip in cash hog markets and a lower mid-week pork market losing early gains which had most months within 50 cents of the monthly highs. Losses of $2-4 US per cwt were recorded in most 2023 and early 2024 contracts shaving more margin from the already thin situation projected for later in 2023.

December lean hogs have traded range-bound between $74-$78 US per cwt since early July but appear to have turned negative with a gap lower to open Thursday’s trading session. At one point nearby contracts traded limit down signifying long liquidation may be on the horizon.

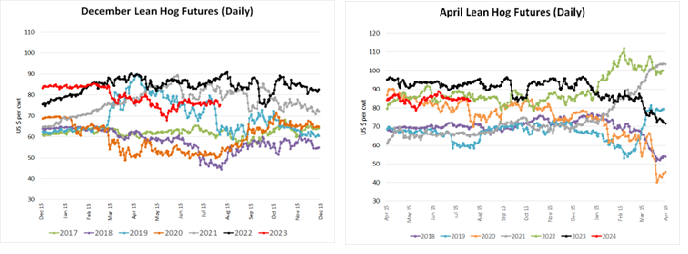

Although lean hog cash markets remain above $100 US per cwt the historical charts clearly illustrate that Dec 2023 and April 2024 are trading in the top 3 position compared to the last 7 years. Also important to note that December, currently near $74 US, has only closed higher once in the past 7 years, that being last year in 2022 when pork demand remained robust.

Hog producers looking to cover production for later in 2023 and early 2024 should consider the highs of the past week and past month as a reasonable starting point for coverage. Although margins may be negative for that period based on current values, risk continue to be present for greater losses should December close closer to its historical levels of the mid $60’s.