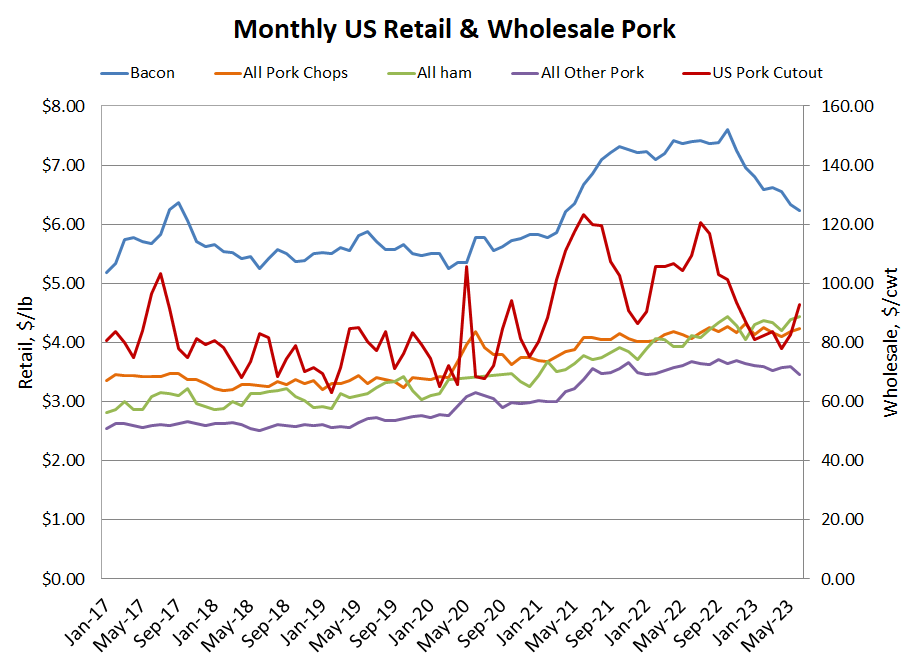

US retail pork prices for the month of June varied, both on the month and compared to a year earlier. Bacon declined -1.8% to $6.22/lb which is -15.9% under last year, while all chops climbed +1.2% from a month earlier to $4.24/lb and is +4.3% over year-ago prices. All hams edged +1.1% higher in the latest data to $4.44/lb which is +7.9% over June 2022, while all other pork prices fell -3.9% to $3.46/lb for the month and is -6.1% under last year. Monthly wholesale pork values rose in all primals for June. US pork cutout at $92.69/cwt jumped +12.2% from May levels, bringing cutout -15.3% under strong year-ago levels. Wholesale bellies were up the most, rising +20.9% for June while picnics, ribs and butts were up +16% to +18% on the month, loins were +8.2% and hams climbed +5.6%. Most pork primal values are currently under values recorded in 2022 with exception to picnics and butts, up 7.1% and +4.4% respectively.

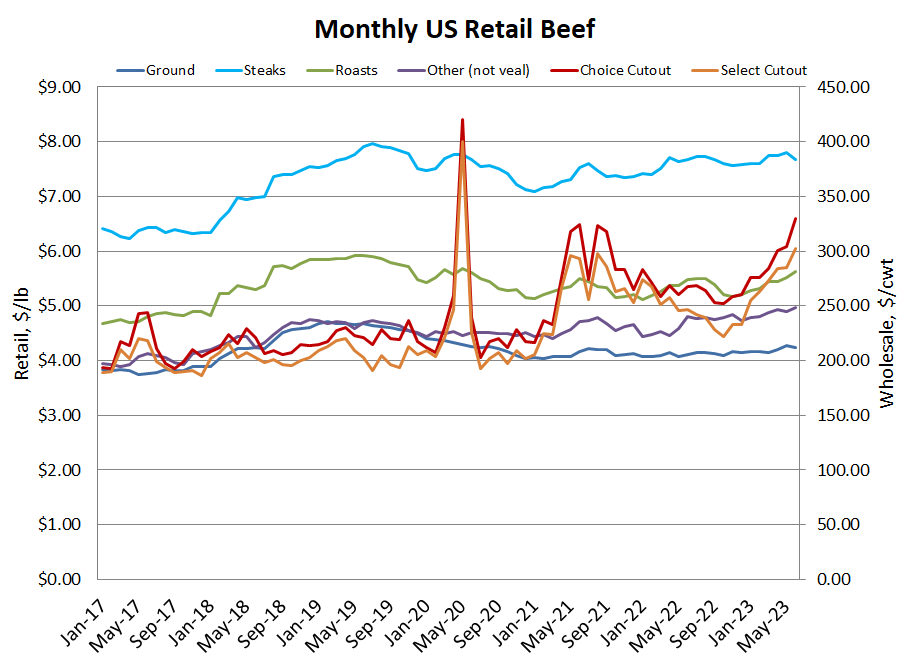

Monthly US retail beef prices were again generally higher in June: Uncooked ground increased +1.5% to $5.44/lb which is +0.6% over last year, roasts slipped -0.6% to $7.02/lb bringing them +3.5% over June 2022, and steaks increased +1.3% to $10.36/lb (a new historical high behind Nov'21 at $10.23/lb) which is +5.4% over last year. All other beef (not veal) edged +0.5% higher to $6.51/lb which is -2.3% under year-ago prices. Wholesale beef values overall increased during the same period, excluding a modest decline in short plates. Choice cutout rose +8.5% in June to $330.19/cwt and is +23.3% over a year earlier, while select cutout climbed +5.9% higher on the month to $302.12/cwt and is +22.5% over last year.

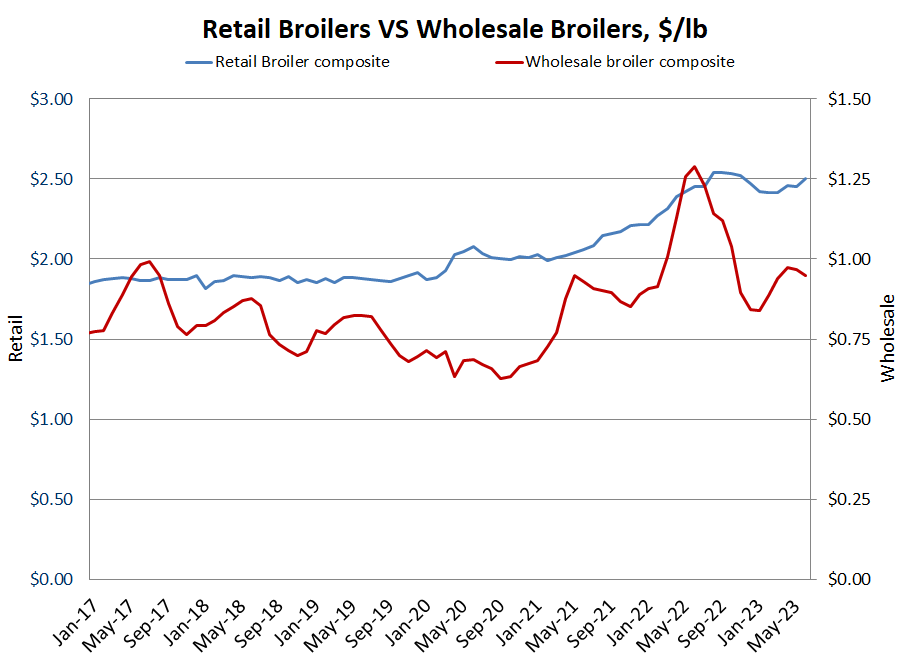

US retail broiler prices at $2.50/lb for June rose +2.0% from May and is +2.0% over a year earlier. Wholesale broiler values declined -2.0% on the month to $0.95/lb which is -26.5% under 2022, with June 2022 representing the historical high at the time of reporting.