-

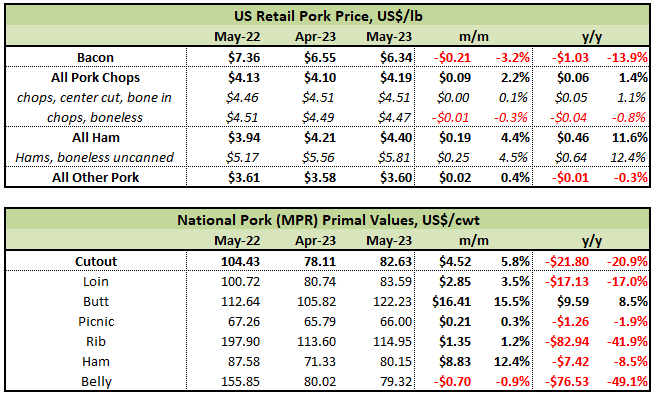

US retail pork prices for the month of May were generally higher on the month, though mixed compared to a year earlier. Chops were +2.2% to $4.19/lb which is +1.4% over May 2022, while all hams rose +4.4% from a month earlier to $4.40/lb and is +11.6% over year-ago levels. Other pork edged +0.4% higher in the latest data to $3.60/lb which is -0.3% under last year, while bacon prices fell -3.2% to $6.34/lb for the month and is -13.9% under year-ago prices.

-

Monthly wholesale pork values rose overall in May. US pork cutout at $82.63/cwt rose +5.8% from April levels, bringing cutout -20.9% under strong year-ago levels. Wholesale butts and hams were up the most from April values while bellies were the only primal recorded lower than the month previous. Compared to last year, most primals are significantly lower excluding butts which are up +8.5%.

-

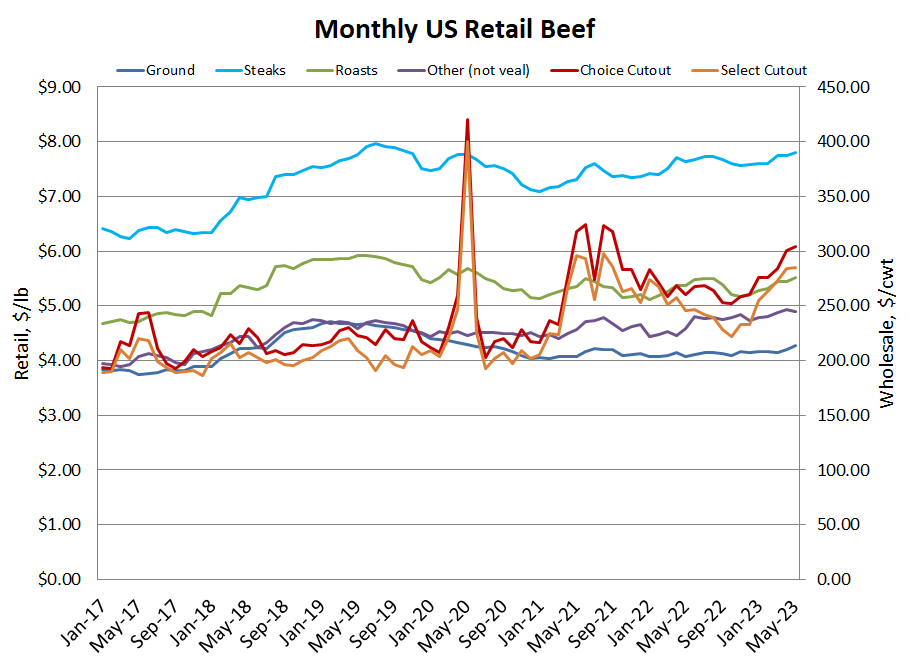

Monthly US retail beef prices were primarily higher in May: Uncooked ground increased +2.1% to $5.36/lb which is +0.4% over last year, roasts were up +3.8% to $7.06/lb bringing them +1.9% over May 2022, and steaks increased +2.7% to $10.22/lb (the second highest historically behind Nov'21 at $10.23/lb) which is +5.5% over last year. All other beef (not veal) declined -1.4% to $6.47/lb which is -2.0% under year-ago prices.

-

Wholesale beef values overall increased during the same period, excluding ribs and briskets. Choice cutout climbed +1.3% in May to $304.40/cwt and is +16.9% over a year earlier, while select cutout edged +0.4% higher on the month to $285.39/cwt and is +16.3% over last year.

-

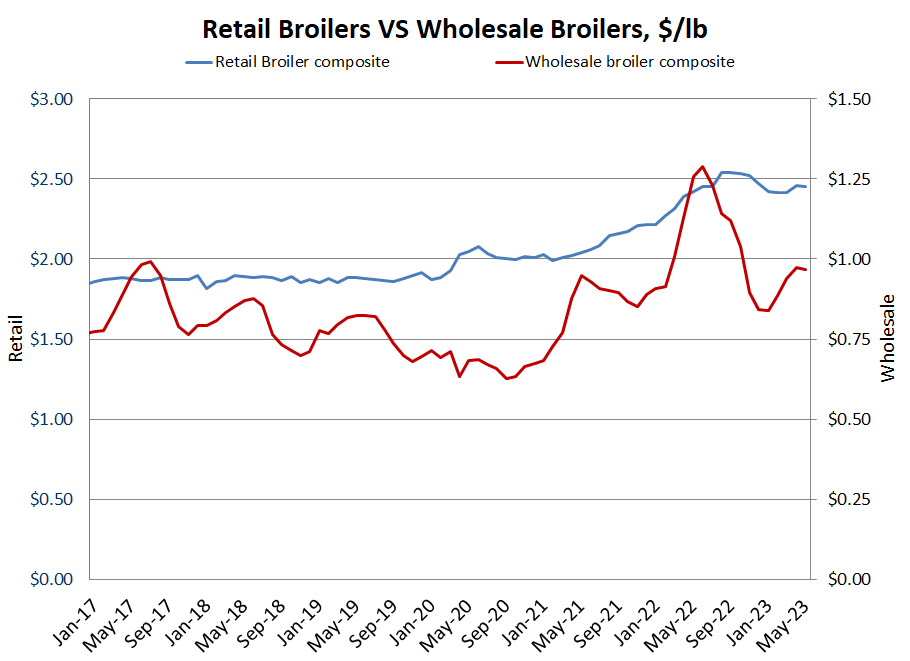

US retail broiler prices slipped -0.3% to $2.45/lb for May, bringing them +1.3% over year-ago prices. Wholesale broiler values declined -0.5% on the month to $0.97/lb which is -23.1% under 2022, with May and June 2022 representing historically high broiler values.